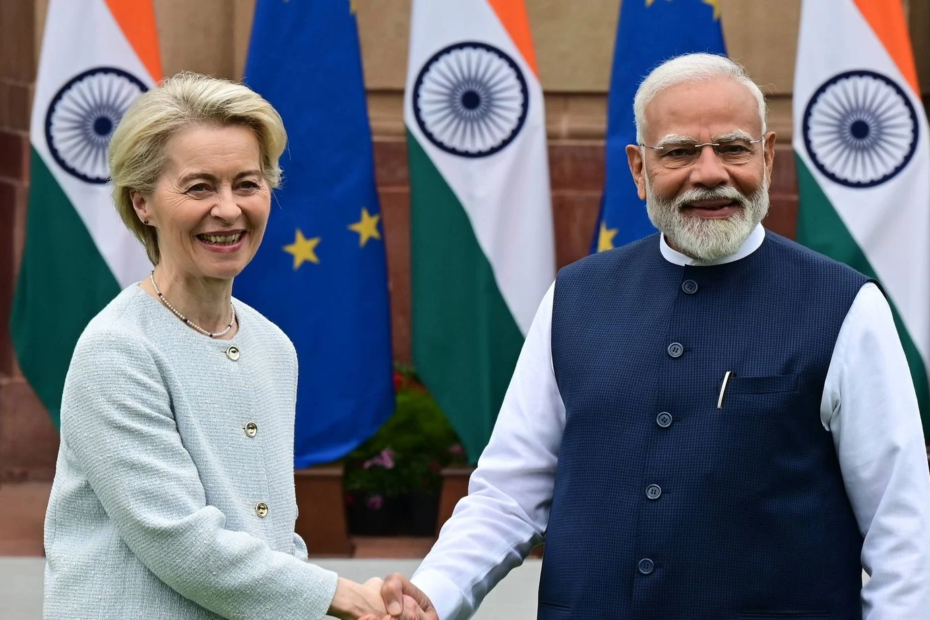

Negotiations between India and the European Union have moved from stalemate to sprint. On 27 January 2026, both sides signed a comprehensive free trade agreement after nearly two decades of on-off talks. Leaders framed the pact as strategic insurance in a fragile world economy marked by supply shocks, tariff disputes, and slower growth. Implementation now depends on legal “scrubbing” and ratification on both sides. India European Union European Commission Ursula von der Leyen (signed), and Piyush Goyal hailed the accord’s scale and timing.

What changed—and why speed matters

Talks relaunched in 2022 but accelerated in late 2025 as both sides sought reliable partners. The 14th and final formal round concluded in October 2025, clearing the path to the January signature. Officials say the agreement will cut or eliminate tariffs on 96.6% of trade by value and could double EU exports to India by 2032, with duty savings near €4 billion. Faster progress reflects a shared need to diversify away from single-market exposure and to harden supply chains.

What the India–EU deal covers

The pact spans goods, services, investment rules, and standards cooperation. EU producers gain lower barriers for cars, machinery, chemicals, and medical devices; Indian exporters receive broader access in textiles, leather, engineering goods, and select agri-products through phased cuts. Sensitive farm lines remain protected. Services chapters seek smoother mobility for professionals and clearer data and certification pathways. A rules-of-origin clause defines how much local value a product must contain to qualify for preferences.

Ratification and the near-term timeline

Signature is not the finish line. The EU requires Council approval and European Parliament consent; India must complete domestic procedures. Legal review could take several months, with operational rollout expected after that. Business advisories see entry into force in late 2026 or early 2027, though some estimates push to 2027–2028 depending on national processes. Meanwhile, firms can map supply chains, build compliance workflows, and prepare product lists for tariff phase-downs.

Trade stakes in numbers

The EU is India’s largest trading partner in goods. Trade in goods reached about €120 billion in 2024, or roughly 11–12% of India’s total goods trade; services trade exceeded €66 billion. Over the last decade, goods trade has nearly doubled and services flows have surged. These baselines shape the pact’s potential: even modest tariff cuts can move large volumes when starting from this scale.

Winners, worriers, and the global backdrop

Export-oriented manufacturers on both sides see the clearest upside, especially autos and components, machinery, chemicals, and higher-value textiles. Logistics, testing, and certification services also benefit as standards converge. However, global volatility still looms. Bond-market swings, currency moves, and a weaker global cycle could blunt early gains. Policymakers argue that the deal itself is a hedge: more partners, more optionality, fewer single-point failures. European commentary frames the pact as part of a wider “open but protective” trade strategy designed to counter coercive shocks without retreating from global commerce.

Political flashpoints to watch

Three issues could shape the ratification debate. First, market access for sensitive sectors, including agriculture and passenger vehicles, where phased cuts and safeguards will be scrutinised. Second, data, digital trade, and privacy rules, which must align with domestic regimes. Third, sustainable-development chapters on labour and environment, which the EU typically enforces through review mechanisms. Clearer texts on these fronts will help parliaments move from principle to assent.

What companies should do now

Firms should build “tariff books” that match HS codes to phase-down schedules; prepare supplier declarations to meet rules-of-origin thresholds; and assess whether to re-site production to maximise preference use. Service exporters can audit licensing and recognition rules to shorten time-to-market once chapters take effect. Public-facing teams should plan for labelling, sustainability, and due-diligence reporting demanded by EU buyers. Early movers will capture quota windows and first-year duty savings.

The road ahead

Momentum is real, yet execution will decide outcomes. If ratification holds to schedule, 2026 becomes a planning year and 2027 the practical start for many tariff cuts. In parallel, the two sides will keep coordinating through the Trade and Technology Council format to manage standards and supply-chain risks. In a choppy global economy, the India–EU track offers a rules-based growth lever—provided both partners turn signatures into shipments, and chapters into everyday compliance.